There are many cases when we face this problem, mostly when we forget our account’s password or PIN code. So an overdraft occurs mainly, when you do a transaction that limits your remaining balance in your bank account. When does the overdraft occur? Mostly asked a question you’ll ever see. Link your checking account to your savings account, and Chase will automatically transfer funds if needed. Tot ODP SWP DR Memo chaseĬhase’s overdraft protection is a great service for those who often find themselves short on cash & is a great way to avoid costly fees and keep your finances in order. You can use this turning line of credit whenever you need it, up to your available credit limit. If you don’t have a Chase savings account or want more flexibility in how much you can borrow, you can sign up for a Chase line of credit.

Without Chase checking & Chase savings account You can either set this up through online banking or contact customer service to set it up for you. If you have a Chase checking account and a Chase savings account, you can automatically transfer money from your savings into your checking if you need to cover an overdraft. With Chase checking & Chase savings, account Here we will discuss how someone can get access to Chase overdraft while having a Chase saving and Chase saving account on hand & how someone can get access without a Chase saving and Chase checking account. The availability of these two accounts decides the access to Chase’s overdraft.

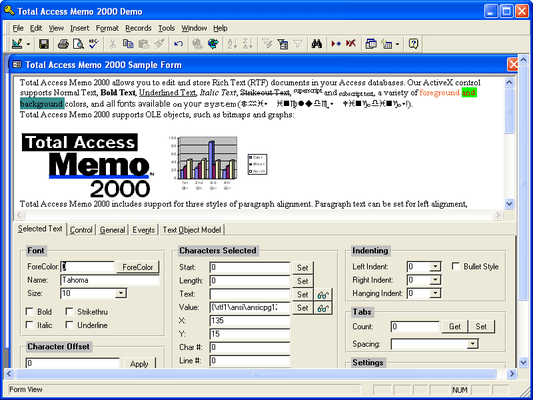

Aside from this, there are many more abbreviations, like Dr.

0 kommentar(er)

0 kommentar(er)